Individual Taxpayer Identification Number

What is ITIN Number?

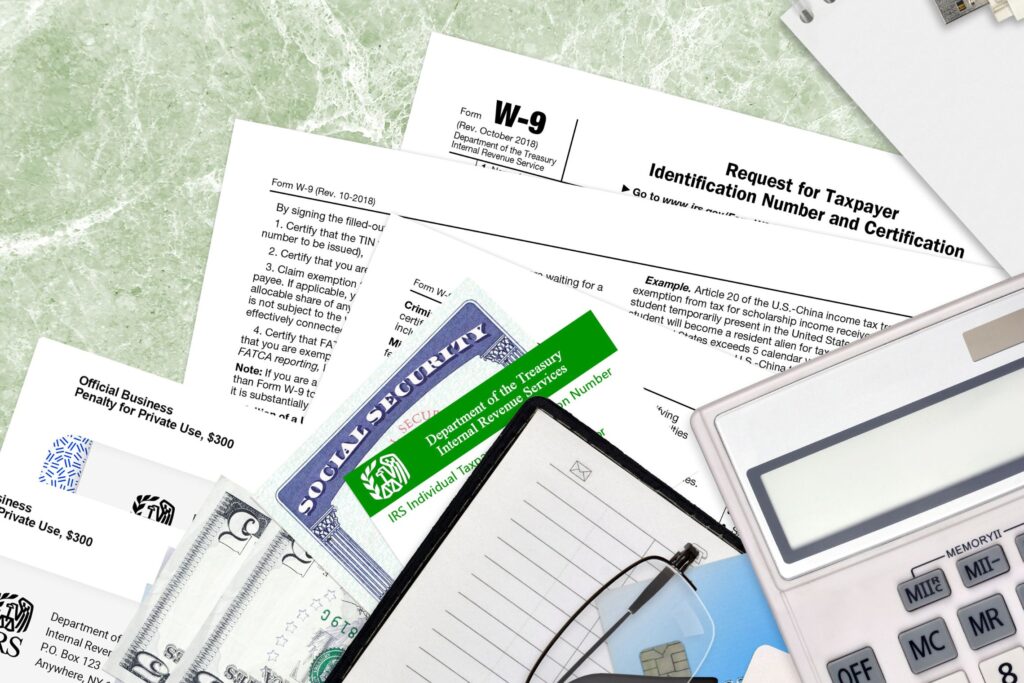

Having an Individual Taxpayer Identification Number (ITIN) is a nine-digit number that is used to file federal taxes and to open an interest-bearing bank account. Although the number is similar to the Social Security Number (SSN), it has a few important differences.

The number isn’t available to all citizens of the U.S. It is only available to certain foreign nationals living in the U.S. It’s also not a means of work authorization in the United States.

Here is our 4-Step Application Process

1-Order your EIN or ITIN Application online from products faster

2-Order system will ask you to help you proof your identity with our secure app

3- Once identity is verified. We will collect required information and documents by form from you

4-You’re done !!! So get relaxed and lean back. Our experienced team will take care of your EIN or ITIN.

Where & When You'll Use an ITIN

ITINs are useful for a number of reasons. They are a way for foreign nationals to pay federal taxes, open a checking account, buy health insurance through the ACA marketplace, get a driver’s license, and obtain a mortgage. They’re also used by students who come to the U.S. under student visas, and by certain survivors of domestic violence.

How Do You Get an ITIN? Apply for an ITIN Online

We provide best ITIN application service to our customers. You can start your ITIN Application online. We apply and get your ITIN as we are a Certified Acceptance Agent. ITIN Applications are reviewed and done by our experienced team.